RPPC Inc – QuickBooks®uses payroll items to track individual amounts on a paycheck and accumulate year-to-date wage and tax amounts for each employee. There are payroll items for compensation, taxes, other additions and deductions, andcompany-paid expenses. You can assign these payroll items to different accounts as needed. When the payroll feature is turned on, QuickBooks®creates […]

RPPC Inc – QuickBooks®Adding an Employee

RPPC Inc – QuickBooks®defines an employee as someone you give a W-2 form to at the end of the year. You pay employees with paychecks and withhold taxes for them. Set up all those who fall into this category as employees. This video will walk you through how to add an employee. For more information […]

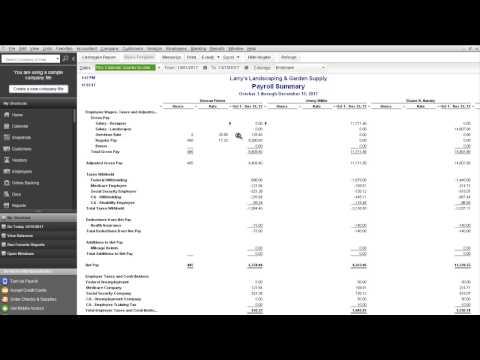

RPPC Inc – QuickBooks®Payroll Summary Report

RPPC Inc – This report shows the total wages, taxes withheld, deductionsfrom net pay, additions to net pay, and company-paid taxes andcontributions for each employee on your payroll. In the report, Gross Pay includes commissions and additions suchas bonuses or tips. Adjusted Gross Pay is gross pay minus anypre-tax deductions such as an employee contribution […]

RPPC Inc – QuickBooks®Statement of Cash Flow

RPPC Inc – The statement of cash flows is the most valuable, the most under-used, and the least understood of the three main financial statements (profit & loss, balance sheet, statement of cash flows). This video will go over the different sections of the cash flow statement. For more information on the Statement of Cash […]

RPPC Inc – QuickBooks®Accounts Receivable Aging Reports

RPPC Inc – Keeping track of the money owed to you is important as it is where you may your money! In accounting, the money owed to your business is referred to as Accounts Receivable (A-R for short). Any open invoices are tracked as AR until you receive the payment. QuickBooks®has two reports that break […]

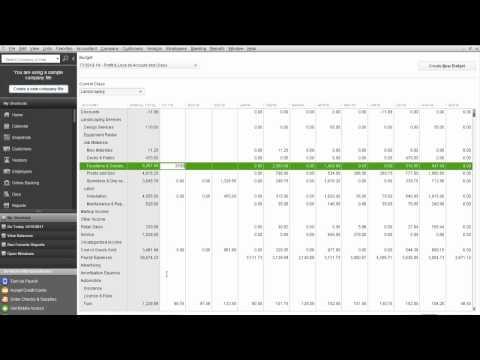

RPPC Inc – QuickBooks®How To Create a Budget

RPPC Inc – Budgeting within QuickBooks®provides business owners and managers with powerful tools for better managing a firm’s operation. A budget can give the business owner, manager, or other QuickBooks®user a way to more easily and more quantifiably manage the people working for the business. A budget can often identify problems or opportunities early and […]

RPPC Inc – QuickBooks®Quick Keys to Change Date

RPPC Inc – If you are entering a lot of information into an accounting program like QuickBooks, you want to be able to keep your hands on the keyboard. Moving back and forth from the keyboard to the mouse just slows you down. That is why we have “keyboard shortcuts” in good Windows based programs […]

RPPC Inc – QuickBooks®Reports For Your Accountant at Year End

RPPC Inc – This video will show you how to access some reports your accountant may want from you at year end. The key is having great financials that you can utilize throughout the year to make good business financial decisions and when tax time comes, it’s no problem. The financials are in good order […]

RPPC Inc – QuickBooks®Set up Users and Control Access

Do you want your A-P clerk having access to your payroll records? Or your billing clerk having access to your profit and loss statements? Maybe so, but maybe not. If not, then you can configure your QuickBooks®company file so that each user has access only to the information they need. This video will show you […]

RPPC Inc – QuickBooks®How To Clean up Vendor Bill Pay Screen

Sometimes QuickBooks®users will create a bill, and then write a check to pay for the same expense, instead of using the bill payment method. Leaving your QuickBooks®file in this condition will overstate your expenses and accounts payable, while your bank account will still reconcile. This video will show you how to clean up the vendor […]

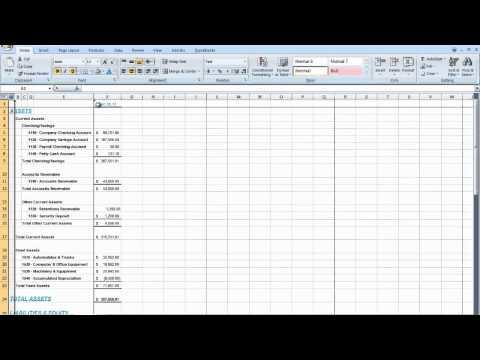

RPPC Inc – QuickBooks®Exporting Reports to Excel | Updating and Existing Worksheet

Occasionally, you may need to change a report’s appearance or contents in ways that aren’t available within QuickBooks.Changes you make in Excel don’t affect your QuickBooks®data, so you’re free to customize a report as needed. If you need more information on exporting reports to Microsoft Excel, please call RPPC at 816.885.0487